By David Foulke

Book Overview

If there is such a thing as a momentum investing 'guru,' Gary Antonacci is that guru. He's run the blog optimalmomentum.blogspot.com for a number of years, and has now published a book, 'Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk' (a copy is available here), that synthesizes his wide experience in momentum investing into a single approach, and makes it available to the investing public.

Personally, I have always found context to be an important tool for learning, and in finance, true understanding often requires knowledge of a broad range of subjects. And that's a great thing about this book: it provides a historical, financial, and academic context that gives the reader a deep understanding of the investing world, and how momentum fits into it.

Jul 8, 2015 - Dual Momentum, a book by Gary Antonacci, looks to minimize these problems. I get a number. The book explains in detail the difference between the two types of momentum-based investing. Print Friendly, PDF & Email. So basically Dual Momentum investing is a refutation of the old axiom 'Past Performance is not an Indicator of Future Results' that is printed on every mutual fund prospectus and is really nothing more than a systematic method of using a 1-year running average of past performance to determine future investments strategy. Yanani.pdf Faber. Dual Momentum Investing Pdf Dual Momentum Investing Pdf We proudly existing Dual Momentum Investing Pdf created by Anja Vogler Mentoring Everybody can review online and also download and install completely free. Dual Momentum Investing Pdf written by Anja Vogler Mentoring is available in word, pdf, ppt, txt, zip, kindle, and rar.

What I like about the book?

Rather than dive directly into a dry discussion of momentum investing, Antonacci tells the story of momentum investing. He starts with the evolution of his own thinking, and an overview of the academic building blocks that give the reader a perspective on the overall investing landscape. He describes how early thinkers observed that stock prices were related to Brownian motion, the subsequent rise of the Efficient Market Hypothesis (EMH), and a common sense discussion of indexing.

But something wasn't adding up for Antonacci, who thumbed his nose at EMH proponents at the University of Chicago (after being accepted into the PhD program there). He saw that certain respected and successful investors, such as George Soros and Paul Tudor Jones, were able to systematically beat the market. Even Nobel Laureate Paul Samuelson, who was an early architect of EMH, invested his own money with Warren Buffett. Meanwhile, in academia, researchers began to ask questions that EMH could not easily answer; they identified various market anomalies, and explored how human behavior might explain them. Among the most puzzling of these anomalies was the momentum effect, which refers to persistence in performance.

Antonacci shares the history of momentum, discussing early momentum investor Jesse Livermore, Value Line's successful use of relative price strength, and other early momentum practitioners, including early Mutual Funds that employed momentum. Next, Antonacci explores a range of insights generated within the academic community, such as Jegadeesh and Titman's seminal 1993 paper, research across asset classes, and possible explanations and enhancements of momentum. Over time, momentum became known as the 'premier anomaly,' and was among the most intensively researched areas in finance.

But there are a few more aspects of modern finance to put in place before getting into the nuts and bolts of various momentum strategies, which are detailed later in the book. Antonacci takes us through Markowitz's mean-variance optimization, the Capital Asset Pricing Model, and the Black-Scholes option pricing model, all of which provide a framework and mathematical intuition for understanding momentum. We also see the 'why' of momentum: Antonacci reviews risk-based and behavioral explanations, including from Kahneman and Tversky, and provides a solid overview of human biases that are thought to drive the momentum effect.

Next, Antonacci covers some ground on asset allocation topics, including a discussion of diversification, Bridgewater's Risk Parity strategy, bonds as a diversifier, and a review of additional asset classes, including international and emerging markets, and commodity futures. Antonacci hints at how dual momentum and relative momentum can be used across these various asset classes as asset allocation and risk management tools, the specifics of which he gets into towards the end of the book. Antonacci also examines how to gain exposure to various factors, including size, value and momentum, and cautions investors against being seduced by the siren song of so-called 'smart beta;' worthwhile advice in an age of misinformation in the financial services industry.

Finally, the stage is set for a discussion of the details of momentum, and Antonacci's Dual Momentum strategy itself. Antonacci describes the well-known concept of relative strength momentum, and also defines the lesser-known absolute momentum. These are distinct branches of momentum, and therein lies the unique contribution Antonacci makes with this book, since he describes way to combine these two powerful, independent momentum effects in order to achieve a hybrid momentum exposure that dynamically allocates within and across asset classes, thus creating superior risk-adjusted returns for the investor.

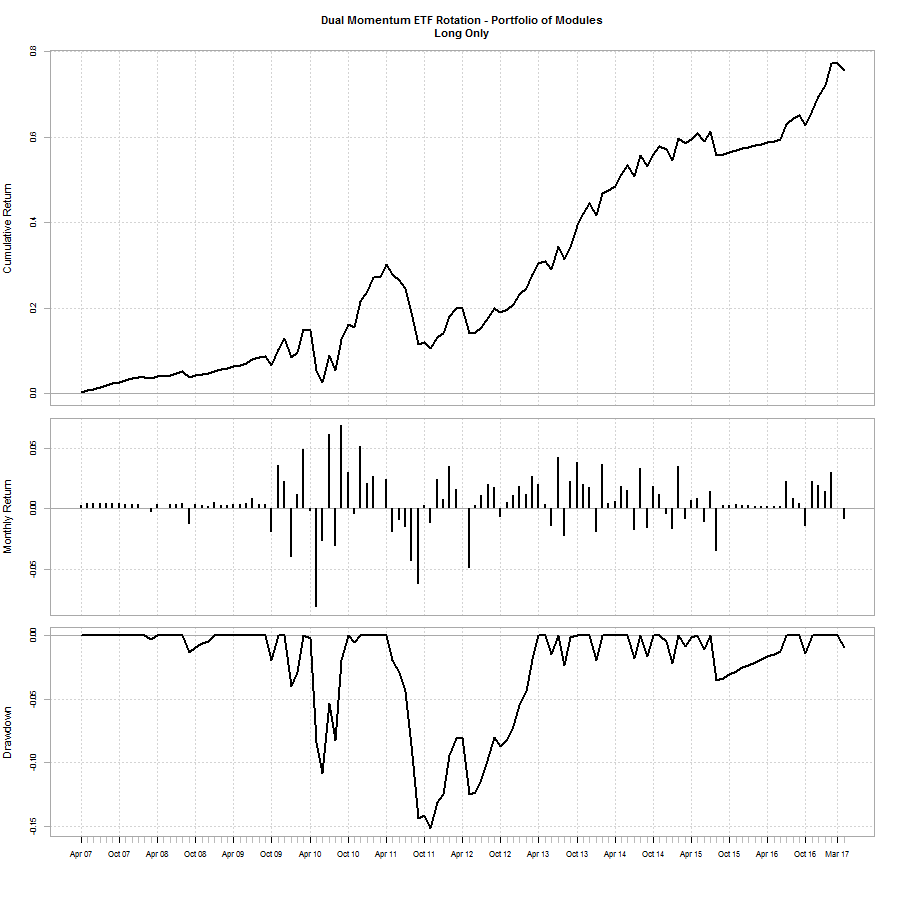

Antonacci demonstrates returns to Dual Momentum and the empirical evidence through extensive backtesting across multiple decades; the analysis includes various risk metrics (returns, standard deviations, Sharpe, drawdowns, etc.), and robustness studies, the interpretation of which he explains in detail, so that the reader can have an informed view of the data.

Dual Momentum Investing Pdf Download Pc

The evidence culminates in a simple but powerful applied momentum model: Antonacci's Global Equities Momentum (NYSEARCA:GEM) strategy, which uses these dual momentum ideas to tactically allocate across and among domestic and international equity and bonds. And the results are nothing short of spectacular: superior returns, with low volatility. When Antonacci regresses GEM returns against established factor models (3-, 4- and 5-factor models), GEM shows statistically significant excess risk-adjusted returns (alpha) across all of them. Antonacci even outlines an ultra-low cost, do-it-yourself approach for investing in GEM that uses ETFs, and gets rebalancing signals from available free online sources.

Antonacci also discusses some interesting variations on dual momentum and related strategies, including trend following using moving averages (MA rules), market timing using valuation (NYSEARCA:CAPE), use of a 52-week high signal, sector rotation, and others. This is all fascinating material, but the book does have a few weaknesses.

Constructive Criticism

Antonacci is a little breezy and imprecise at times; for instance, he defines portfolio insurance as a concept 'developed by several finance professors who said investors should increase their long exposure when markets move up quickly and decrease their long exposure when markets drop quickly.' That seems like perhaps a bit of an oversimplification of an idea that has been fairly extensively researched. It is a fairly complex area, however, so perhaps Antonacci simply didn't want to get into too much detail. Also, some of the sections were a bit of a hodgepodge, and felt disjointed at times. For example, during a romp through modern portfolio theory, in the space of about a single page Antonacci leaps from Mandelbrot's Cauchy distribution, to Bachelier's early option pricing, to Long-Term Capital Management, in a sequence that left me slightly reeling.

It may be, however, that his book simply is not particularly geared for those who do not already possess a good degree of familiarity and facility across these somewhat obscure areas of finance. And in fairness, Antonacci also advises less interested readers they can skip lightly over the more heavily wonkish sections. Still, if you can't keep up with Antonacci, perhaps you should read some other finance books first. Also, for those who are pushing the boundaries of their knowledge, Antonacci does include a helpful Glossary.

Summary:

Despite these shortcomings, which might render parts of Dual Momentum less than totally accessible to the layman, I thoroughly enjoyed the financial theory and academic history laid out in the book. And of course the treatment of momentum is first rate. If you want to learn about the momentum anomaly, this book is an excellent place - or perhaps the best place - to start.

Momentum has been observed across financial markets over long time frames, but the momentum investment style has yet to achieve widespread acceptance within the investing public. This is immensely puzzling. Ben Graham inspired legions of copy-cat value investors, but where is the Ben Graham of momentum and where are the legions of momentum traders? In a world where investors usually seek to combine uncorrelated risks of all stripes to achieve better risk-adjusted returns, momentum seems like a 'no-brainer' addition to a portfolio. Yet this is often not the case.

Our own personal experience provides some anecdotal evidence. We visited a large ($4bn) university endowment recently who said they had no assets allocated to momentum strategies and seemed only vaguely familiar with the concept. That's quite stunning when you think about it: momentum is arguably the most significant anomaly within academia, yet the endowments won't touch it with a 10-foot pole. Amazing. Perhaps this is because many still view momentum, through an EMH lens, as 'voodoo' finance. Or perhaps they just are unaware of the evidence. Regardless of the reasons, investors should seek out the benefits of momentum, and Gary Antonacci's 'Dual Momentum Investing' provides both a fantastic introduction to momentum investing, as well as a sophisticated discussion of and an approach to achieving risk-managed exposure to the anomaly across asset classes. I also heartily recommend it to anyone who wants to broaden their finance knowledge.

Momentum investing is a system of buying stocks or other securities that have had high returns over the past three to twelve months, and selling those that have had poor returns over the same period.[1][2]

While no consensus exists about the validity of this strategy, economists have trouble reconciling this phenomenon, using the efficient-market hypothesis. Two main hypotheses have been submitted to explain the effect in terms of an efficient market. In the first, it is assumed that momentum investors bear significant risk for assuming this strategy, and, therefore, the high returns are a compensation for the risk.[3] Momentum strategies often involve disproportionately trading in stocks with high bid-ask spreads and so it is important to take transactions costs into account when evaluating momentum profitability.[4] The second theory assumes that momentum investors are exploiting behavioral shortcomings in other investors, such as investor herding, investor over and underreaction, disposition effects and confirmation bias.

Seasonal or calendar effects may help to explain some of the reason for success in the momentum investing strategy. If a stock has performed poorly for months leading up to the end of the year, investors may decide to sell their holdings for tax purposes causing for example the January effect. Increased supply of shares in the market drive its price down, causing others to sell. Once the reason for tax selling is eliminated, the stock's price tends to recover.

History[edit]

Richard Driehaus is sometimes considered the father of momentum investing but the strategy can be traced back before Donchian.[5] The strategy takes exception with the old stock market adage of buying low and selling high. According to Driehaus, 'far more money is made buying high and selling at even higher prices.' [6]

In the late 2000s as computer and networking speeds increase each year, there were many sub-variants of momentum investing being deployed in the markets by computer driven models. Some of these operate on a very small time scale, such as high-frequency trading, which often execute dozens or even hundreds of trades per second.

Although this is a reemergence of an investing style that was prevalent in the 1990s,[7]ETFs for this style began trading in 2015.[8]

Effectiveness[edit]

In a study in 1993 Narasimhan Jegadeesh and Sheridan Titman reported that this strategy give average returns of 1% per month for the following 3–12 months.[9]

Dual Momentum Investing Pdf Download Software

The performance of momentum comes with occasional large crashes. For example, in 2009, momentum experienced a crash of -73.42% in three months.[10]

See also[edit]

References[edit]

- ^'Momentum Investing Definition | Investopedia'. Investopedia.

- ^Low, R.K.Y.; Tan, E. (2016). 'The Role of Analysts' Forecasts in the Momentum Effect'. International Review of Financial Analysis. 48: 67–84. doi:10.1016/j.irfa.2016.09.007.

- ^Li, Xiaofei; Miffre, Joelle; Brooks, Chris; O'Sullivan, Niall (2008). 'Momentum profits and time-varying unsystematic risk'. Journal of Banking & Finance. 32 (4): 541–558. arXiv:quant-ph/0403227. doi:10.1016/j.jbankfin.2007.03.014. ISSN0378-4266.

- ^Li, Xiaofei; Brooks, Chris; Miffre, Joelle (2009). 'Low-cost momentum strategies'. Journal of Asset Management. 9 (6): 366–379. doi:10.1057/jam.2008.28. ISSN1470-8272.

- ^Antonacci, Gary (2014). Dual Momentum Investing: An Innovative Approach for Higher Returns with Lower Risk. New York: McGraw-Hill Education. pp. 13–18. ISBN978-0071849449.

- ^Schwager, Jack D.. The New Market Wizards: Conversations With America's Top Traders. John Wiley and Sons, 1992, (pg. 224), ISBN0-471-13236-5

- ^Waggoner, John (September 9, 2016). 'Momentum investing gaining speed among financial advisers'. Investment News. Retrieved November 2, 2016.

- ^'Comparing Investor Options in the Momentum ETF Space'. ETF Daily News. September 21, 2016. Retrieved November 2, 2016.

- ^Jegadeesh, N.; Titman, S. (1993). 'Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency'. The Journal of Finance. 48 (1): 65–91. doi:10.1111/j.1540-6261.1993.tb04702.x. JSTOR2328882.

- ^Barroso, Pedro; Santa-Clara, Pedro (April 2015). 'Momentum has its moments'. Journal of Financial Economics. 116 (1): 111–120. doi:10.1016/j.jfineco.2014.11.010.

Further reading[edit]

- Soros, George, 1987, The Alchemy of Finance, Simon and Schuster, New York.

- Tanous, Peter J., 1997, Investment Gurus, New York Institute of Finance, NJ, ISBN0-7352-0069-6.

- Antonacci, Gary, 2014, Dual Momentum Investing: An Innovative Approach for Higher Returns with Lower Risk, McGraw-Hill Education, New York, ISBN0071849440

- The Definitive Guide To Momentum Investing and Trading, Signal Plot, August 24, 2017